Maritime Services Centres Index (MSCI)

Maritime Services Centres Index (MSCI)

To develop a Maritime Services Centres Index (MSCI) to update and improve analysis of comparative competitiveness of maritime service centres.

Objective

To provide a dynamic view of maritime service centre competitiveness covering a wide variety of centres (e.g. Shanghai, Singapore, London, Hamburg, Piraeus, Capetown … perhaps 30 to 60 cities globally) with a more dynamic interpretation of changes in the input factors and their effects on maritime service activity. The MSCI could be used to (1) better inform UK public policy makers of the trends affecting the maritime services sectors, (2) draw attention to relative competitiveness of centres, (3) better analyse the input factors that improve competitiveness, (4) draw attention to the importance of maritime services to a successful, diverse economy, and (5) create an international community of professionals interested in regulatory, policy, fiscal, planning and infrastructure issues affecting global maritime service clusters.

Approach

The approach suggested would be similar to another type of index that Z/Yen have developed, the Global Financial Centres Index (GFCI) - Long Finance - GFCI

The MSCI would be based on two types of input – factors of maritime center ‘competitiveness’ by city compiled by Z/Yen from available sources, and a regular online assessment completed by maritime professionals. The factors of competitiveness that might be included within the MSCI would include quantitative factors related to:

- general national competitiveness and trade, GDP, imports/exports, etc.;

- general city competitiveness and trade;

- general shipping indicators both nationally and by city, e.g. tonnage, inspections, container traffic, financial transactions, port capacity within 50km, rail capacity, etc.;

- fiscal environment, both for business generally and for shipping, in the base country or city;

- employment-cost environment in the base country, in particular the degree of flexibility in terms of crewing (both general conditions regarding the ability to employ non-national crews and any tax/other alleviations relating to the employment of nationals);

- restrictions on access to the normal markets in terms of trade, finance, basic tools of the trade (e.g. shipbuilding and equipment), etc;

- technical, operational, labour or other standards in the base country;

- concentration of persons with the necessary skills and expertise including the education/training environment;

- the legal environment in relation to the fiscal environment.

The regular online assessments would be provided by the wider maritime services community, which would be analysed, both overall and by segment, including:

Further, a successful MSCI might well be an input index to the GFCI and Z/Yen considers this feasible, and desirable, for both indices.

Analytical Engine

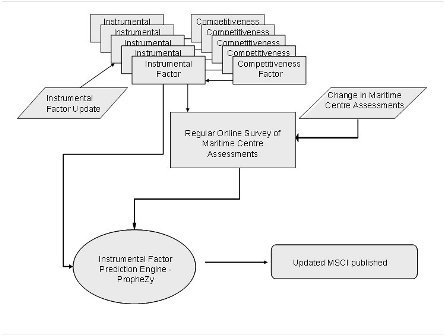

The MSCI would be based upon a component factor model and an outline of the basic process is the following diagram:

For the MSCI, the component factor calculation engine (PropheZy, provided by Z/Yen as part of the project) would then answer this type of question:

If a maritime lawyer rates London and Singapore with certain ratings, then, based on the set of index scores for London and Singapore, how would that person rate Hamburg based on the set of index scores for Hamburg?

From these calculated ratings, the overall index numbers would be generated.

Output

The MSCI would provide a regular evaluation of changes in city competitiveness. It would generate regular news and analysis. There is the potential to build a community/club of a few thousand global maritime services professionals globally into an effective, albeit changing group, centred around London, yet independent and holding strong local interests. The MSCI that would be dynamically updated by either new factors or new participant assessments. There are ‘news’ opportunities when:

We would propose that the web-based survey of the ‘club’ be done, ideally, on a quarterly basis. The idea would be to get a group together such that at least 400 responses could be gained per annum, at least 100 per quarter, with the assistance of contacts and networks, e.g. through the shipping mutuals.

Next Steps This document is designed to initiate conversation. Z/Yen is interested in exploring these issues further with all parties. Please contact Michael Mainelli, Director, Z/Yen Group Limited, Michael_Mainelli@zyen.com