Risk Management

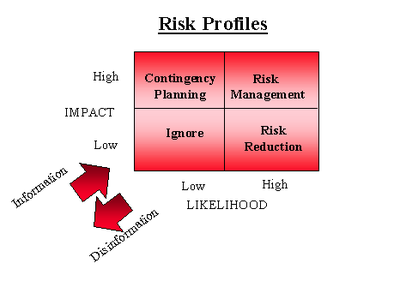

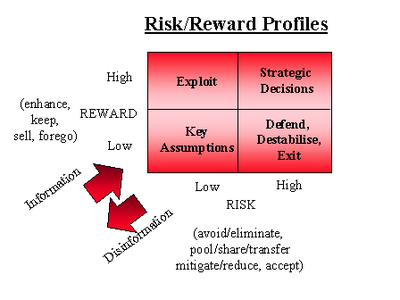

Risk management is the process of controlling risks in order to improve performance. Risk management is one-half of Z/Yen’s risk/reward methodology. Risk management is a popular topic and people in a variety of fields, such as banking, insurance, manufacturing, health, engineering, defence, the environment and the voluntary sector, are showing interest in how effective it seems to be at enhancing performance and the certainty of performance. As an introduction to risk management, two frameworks are worth considering in order to get a flavour of the field, the categorisation of risk and the mechanisms for handling risk:

From its experience in establishing risk management systems, Z/Yen believes in an evolutionary approach towards a full, viable systems model. Z/Yen’s problem-solving methodology, Z/EALOUS examines the environment and objectives, analyses the risk issues, examines the likelihoods and impacts, establishes the opportunities, promotes risk understanding and sharing. Z/EALOUS helps clients raise risk management through four increasing levels of sophistication:

- Awareness: the basic level consists of highlighting the importance of risk management, establishing centres of knowledge, applying basic standards or accreditation, and integrating risk management with corporate ‘scorecards’;

- Engineering: at the risk engineering level, key individuals are applying risk management techniques to larger projects or issues. Engineering is typically offline, technical analysis using stochastic or simulation techniques which is then brought to the organisation’s attention through value studies or project finance decisions;

- Comparative: where risk management is a strong feature in management awareness and evaluation through personnel assessment, benchmarking or league tables;

- Systemic: where a ‘viable’ risk management system provides an internal market, external pricing and verification, dynamic re-alignment of the risk system with strategic direction and best practice sharing through peer review, databases and publications.

Z/Yen has helped organisations at each stage, and through all four stages. For instance, working with a major financial institution Z/Yen highlighted the importance of risk management in operations, proceeded to re-engineer many of the back and middle office processes, developed risk comparators in conjunction with the internal audit team and finally helped the organisation to develop macro-structures such as insurance captives and re-insurance for external pricing and verification. Z/Yen thrives on risk management problems.