Risk/Reward In Virtual Financial Communities

By

Professor Michael Mainelli

Published by Information Services & Use, Volume 23, Number 1, IOS Press, pages 9-17.

Abstract: Virtual communities in finance range from informal networks of people helping each other, e.g. Motley Fool chat rooms, through to sophisticated services such as Paypal or credit derivative exchanges. The key issue in finance (as in many other web areas) is 'trust'. Trust goes beyond security or payment into areas such as confidence, probabilistic forecasts or guarantees. Real financial communities are exploring a wide variety of technologies as community interaction moves online.

Keywords: finance, communities, trust, risk/reward

Introduction

In these post-Enron, post-WorldCom, post-Adelphia, post-Global Crossing days - financial communities might seem like a sick joke. What have financial communities ever done for us?

Well, quite a lot actually. Since the beginnings of recorded civilization, the financial world has coalesced into communities. The first solid evidence of multinationals dates back to the Assyrian Empire. From readings of cuneiform tablets, we believe that the Assyrians held regular meetings of their financial communities . Certainly the subsequent Phoenician, Greek and Roman civilizations had financial exchanges. The mediaeval period had its markets and town fairs leading to the emergence of Northern Italy as a center for trade finance. A recognisable modern exchange appeared in 16th and 17th century Amsterdam, complete with derivatives, share ramping and its own version of internet mania, most famously the Tulip Bulb Bubble of the 1630's. Some historians make the case that the strong position of Western Europe in global history was possible because of its resourceful financial markets.

Despite the high-profile scandals and skullduggery in today's papers, good things have come from good financial communities. Financial communities have made possible the joint stock limited companies that power our economy, pension funds, insurance companies and many other forms of investment. Financial communities allow resources to be deployed where they generate the best return - it is better to build new roads in developing countries than advanced economies, and the deferred returns will sustain the advanced economies future pensions. Without the ability to entrust others to undertake financial actions on our, and others, behalf, society could not function.

As technology affects society worldwide, it is hardly surprising to find that technology affects finance. In fact, as finance is largely trading risks and rewards, combined with exchange of information, one could reasonably expect finance to be in the forefront of online societal activity. As much of finance is pure information, quite a bit has moved online already. Financial information services such as Reuters and Bloomberg have long served as proprietary networks, close to, but not as open as, internet services. Yet for finance to function, the risks implicit in new information must be traded in vibrant, liquid markets. Virtual financial communities, for the purposes of this paper, may be described as "natural communities of financial participants who have elected to exchange information and/or transactions via online services."

Categorising Financial Communities

There are a number of ways of viewing finance. One categorization separates financial communities into five groups - wholesale, retail, consumer, regulatory and support services (e.g. products, information services and systems). This paper is principally about changes in wholesale financial communities, rather than the consumer-based finance of balancing cheque book or visiting a local bank branch. Wholesale markets are where professional firms meet to transfer risk and to fund each other. Some of these firms are also household names, Deutsche Bank, ABN Amro, Citicorp or Merrill Lynch. Some of these firms are only vaguely known to consumers, Goldman Sachs, GMO Woolley or Morgan Stanley. The larger multinationals also operate in wholesale finance, BP, Shell or GE for instance.

The retail markets handle small and medium-sized enterprises - everything from corporate bank accounts to trade finance, insurances, factoring and credit. Much of this is moving online, for example Orbian, a Citigroup-led initiative for global discounting of invoices backed by settlement guarantees which describes itself as a member community. The consumer markets handle people - everything from cheque books to life insurance, credit cards, car loans and mortgages. Consumer markets, measured in numbers of transactions, have been growing wildly over the last 20 years.

There are some interesting virtual financial communities arising in retail and consumer markets, from e-portals to novel payment systems such as Paypal, an email based payment system that is rapidly going global. As of 2002, PayPal has 17 million consumers and 3 million businesses in nearly 40 countries. It competes with the old wire transfer services that have been so expensive and hard to find these last 20 years, and now handles millions of transactions weekly. Another example of a new virtual financial community for consumers is Motley Fool, which offers advice in numerous countries to retail investors. Much of this advice is provided by the community, that is, investors advising each other.

It is important to recognize that regulators are quite important in financial communities. In some countries the central bank is both a regulator and a bank. In many countries stock exchanges retain important regulatory functions. Central bank or stock exchange rules can limit the speed or degree of moves to virtual communities. It is also crucial to realize that support services such as information services providers or crossing networks influence wholesale markets and regulatory functions. In the wholesale markets, volumes are increasing rapidly due to increasing retail activity; institutional clients are investing cross border and executing in a variety of markets; and competition is arriving as technology reduces the barriers to entry. New market operational procedures, frequently imposed by regulators, drive shorter settlement times and STP (straight through processing) efficiencies.

On top of all this, society expects more, much more, by way of responsibility from its financial services. A lot of terms are bandied about - stakeholder inclusion, social responsibility, ethical corporations, strategy, risk management, controls, enterprise risk/reward. Society is groping towards the means of balancing organizational activity with responsibility to the community. While this is, on the face of it, unobjectionable, the reality is some confusion, complexity and extra cost.

Driving Forces in Financial Communities

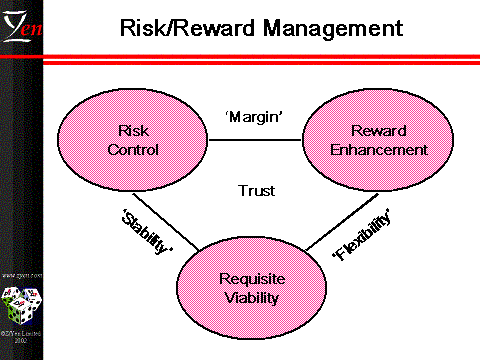

The key issues for virtual financial communities are three: risk control, reward enhancement and volatility reduction. Much technology has been dedicated to risk control. Public Key Encryption is one example, but there are numerous others, Secure Socket Layer, online catastrophe insurance, the proliferation of passwords, certification, trusted third party software, etc. Risk control can be overly dwelt upon, but the most important issue in all surveys of online virtual financial communities is SECURITY.

Reward enhancement is arguably the biggest benefit for today's users. They benefit from economy - eliminating brokerage charges and fees. Clearing and settlement fees have been reduced by 25% in the last year alone, trading costs have been reduced in the FX markets by 10%. Communities are finding that they are increasingly effective in building new markets. For instance, CreditEx and CreditTrade have been fundamental in the rise of credit derivatives in less than four years. New online communities make new risk transfer possible - for instance weather risk using gambling markets as a hedge or insurance companies moving into football pools to cover player bonuses.

Finally, and almost unseen, financial communities reduce volatility. This is a brave statement to make looking at today's markets or going as far back as 1999 and thinking about the collapse of Long Term Capital Management, but it's true. Despite the ever increasing amounts traded, netting and collateral management are reducing exposures. Many problems on today's scales would have brought several institutions, if not whole markets, down with them, yet they still run. However, at heart, most advanced financial products are intended to reduce volatility, whether they are trade finance products, hedges on certain positions or advanced derivatives designed to "cap and collar" certain conditions.

Defining Community

It is difficult to define a community. One can start with the idea that communities define themselves, e.g. "I am an accountant", "I am an academic", "I work with banks", "We belong to the SWIFT network", "I have to make our reports to X regulator"… However, this illustrates the complexity - people belong to multiple communities, some voluntary, some imposed, some of which they're proud, some of which they wouldn't consider communities. If we can set out six characteristics of communities we can see that it is possible to be a member of multiple communities, e.g. banking, insurance, repo-trading, or inter-bank loans, while still belonging to a more nebulous community of wholesale banking:

- common history and purpose: the fundamental reason or passion for joining is clear, making money, and there is a great sense of time, e.g. banks tracing their origins back centuries, such as Monte dei Paschi di Siena (1472) or British merchant banks;

- shared knowledge and culture: there is a common cultural context, principally risk and reward determine "how we decide to do things around here". "Risk transfer" and "who gets the rewards" are common ways of viewing problems. There are strong, informal cultures, as described in books such as Liar's Poker, by Michael Lewis (Hodder & Stoughton, 1989), with its tales of "big swinging dicks", or strong, formal cultures such as those imposed by trade associations or professional bodies for accountants, actuaries, stockbrokers, etc;

- common practices: there are known procedures and benchmarks for operations and conduct. In finance, many of the products are well-known commodities arranged in new combinations. Even shared jargon indicates that common practices proliferate;

- co-location in space and time: there is shared physical and virtual space with known periods of interaction. Although there is a move online, historically financial communities have congregated at a limited number of international locations, e.g. London, New York, Chicago, Tokyo, Frankfurt. Why else does every trading room need to show the time at key locations around the world? Even in virtual space, online exchanges find that they need to schedule times for particular markets in order to ensure liquidity;

- common action: lobbying as a group for their own interests. There is intense lobbying of regulators, governments and trans-national organizations in order to ensure the proper functioning of markets. Further, financial communities create common utilities to further shared interests, e.g. Clearstream or SwapsWire;

- co-created future: financial communities have shared visions of the future - smarter, cheaper, faster, integrated, e.g. an all-electronic world of straight through processing, real-time settlement and online anomaly detection combined with intense visualization. Financial communities cooperate in building towards these visions, although some are open-ended research, e.g. Z/Yen's $3 million Financial Laboratory visualising financial risk in 1997, and even though many fail, e.g. the Global Straight Through Processing Association which closed this year after $100 million from a consortium of financial institutions.

It is hardly surprising to see that people working in wholesale finance form communities. In fact these communities are surprisingly strong, frequently transcending national communities, e.g. the French banker who would rather work in London because it has a "more appropriate culture for my work" or the British insurer who would rather work in New York "because these people know how to do business my way".

Technology for Communities

The remainder of this paper will explore some of the ways in which these virtual financial communities are using technology to build themselves. There are at least seven ways in which virtual financial communities use technology:

- connection: direct ability to contact and transact business. As much of this consists of voice, private network and internet connectivity, as well as the fact that the huge scale of investment in telecommunications by financial firms is well-known, this will not be explored further. It shall be assumed that readers are familiar with the enormous appetite of financial firms for routers, optical fibre, email, information systems, displays, etc;

- communication: financial markets live on information and there are some new ways of conveying this through new technology;

- context: building common practices is hard work, but some technologies are making the construction of common practices easier;

- contribution: sharing knowledge is difficult. It is conceptually difficult to describe or measure what sharing knowledge means, let alone build easy-to-use systems for knowledge sharing;

- consensus: financial firms need to be able to agree rapidly on certain basics or all financial exchange becomes expensive. Some newer technology applications are helping build consensus in rapidly changing markets;

- collaboration: in many cases, financial firms need to work together and newer technology is aiding this;

- commitment: as some technology weakens the importance of personal relationships, e.g., if and when I need something I'll email, other technologies are trying to create "buy in" to communities, to bind people to the communities of which they are part.

Communication

While a number of technologies aid communication, e.g. fax, voice networks, voice mail, email or video-conferencing. It is not hard to perceive that financial markets almost live on 'gossip'. Financial markets were early adopters of more fluid information management systems such as Lotus Notes. Recently, the hunger for communication has been evident in the rapid adoption of instant messaging. One of Bloomberg's most popular services has been instant messaging, later adopted by Reuters. Institutions are adopting instant messaging internally, e.g. UBS Warburg and ABN Amro (MindAlign), or as consortia, e.g. CSFB, Goldman Sach, Lehman Brothers, Merrill Lynch, JP Morgan et al (Communicators Hub IM).

Firms are also experimenting with advanced "drop-in/drop-out" online video, virtual trading floors where one can look through the "London" office into the "New York" office through a semi-transparent screen. The continual thirst for information has meant that financial firms are very early adopters and promoters of translation software - they need all the information they can get, from whatever source, in whatever tongue.

Context

The thirst for information is all too frequently over-quenched. Financial firms almost drown in the amount of information they consume, frequently missing opportunities in the torrent of data. There are numerous experiments with ways of structuring information for users. At the same time, these experiments need to encourage users to participate, help users to build context for subsequent users and generally contribute to making things easier to use for succeeding generations of the community.

Context-building technology is in its infancy. Within firms, intra-nets provide some basic context. Additionally, portals and billboards help people to find essential information. More difficult is moving from "pull" technologies, i.e. those where people know how to find it if it's there, to "push" technologies, i.e. those which help people find what they ought to know. A number of sifting, sorting and profiling tools make extravagant claims, e.g. Excalibur or Autonomy. Workflow software is being used to help structure common sets of information for semi-standardised transactions. Agent software is being used to trade information within firms, e.g. credit risk information on clients. The core problem is that one person's "structure" is another person's "straightjacket", preventing them from conveniently finding what they need. On the other hand, structure-less environments are completely open to the charge that there is tonnes of data but no information.

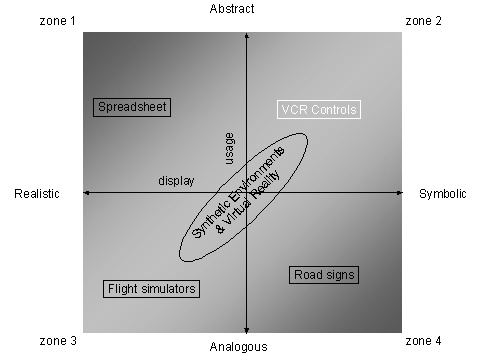

A big contextual void is a shared view of finance. A number of attempts at visualization have failed to provide a "common view of the world". Visualisation can be categorized on two axes - are we displaying a realistic or a symbolic environment, and are we making the user work in an analogous or abstract environment? Problematically, because financial information is already both realistic and symbolic (the number is the number, as opposed to, for example, simulating shipping on a map or from a simulated bridge), it is difficult to build simulators which are not themselves quite abstract. In fact, if we could build simulators for trading that appealed to the primal nature of humans (find fruit and mates while avoiding predators), paradoxically, the computers would be so powerful at processing information for trading decision that the humans would likely be unnecessary. This is a somewhat round-about way of justifying the fact that many trading floors are full of scrolling screens of financial numbers as opposed to "virtual environments" where people might "interact with financial risk". Without a compelling, trusted simplification of the complexity of information, traders are going to trust the raw data.

Contribution

Getting people to contribute to a community without coercion is an ancient problem, the classic "free rider" issue. Why give back for something you get for nothing, or next to nothing? Yet, much of the internet has been built on community sharing. For financial communities there are a large number of "chat" rooms, bulletin boards, usenets and others means of structured discussion. Many of these are extremely popular. People's desire to improve their understanding by engaging in debate seems to be enhanced, not retarded, by moves online. Everyone can be a financial pundit or publisher of financial snippets.

A number of firms are taking these contributions and structuring them even more. "Knowledge management" software stretches across a range of applications from the mundane to exotic vaporware. Some mundane applications have been data warehouses, sharing browser "favorites", e.g. Backflip, sharing knowledge taxonomies, e.g. Dexer, or providing "case management software" similar to that found in managing medical treatments, where highly experienced professionals help more junior ones by showing how they might address problems. Case management software is often intertwined with expert systems. However, more complex systems are often technology demonstrators, not real applications. Much of the mundane work is getting people to contribute through easy-to-use threaded conversations.

There has been a real struggle to marry creative ideas with inducements to contribution. One of the early ideas was Six Degrees. There is an urban myth that we are connected to everyone else by at most six connections, somewhat based on mathematical guesses as to the number of people we each know raised to the sixth power. Six Degrees took this to its logical conclusion - use the internet to document these connections. With documentation came new connections. The power of the tool for networking and relationship management, if it endured, is evident. Enduring popularity is elusive - Six Degrees fizzled out.

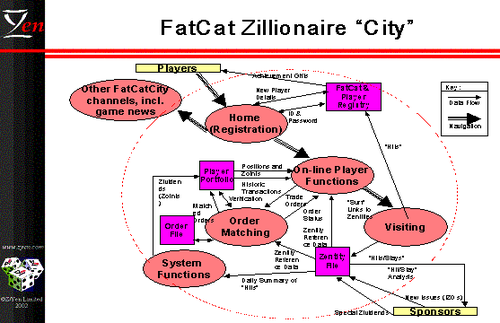

Some of the more interesting work in collaboration involves getting people to contribute through entertainment, i.e. playing games. These games range from surveys with jackpots to virtual trading. Z/Yen created one prototype for a company, Zaroo, where a patent was awarded for building a game around "web entity" popularity - FatCat Zillionaire. FatCat Zillionaire's potential strength is in looking at the future perceived popularity of web entities rather than today's hit rate. It works by grouping web pages, e.g. financial chat rooms, into "shares" and then letting players trade shares while receiving dividends based on a "hit" algorithm. When the share price divided by today's hit is high (high Price/Earnings ratio), this is a strong indication that the future perceived popularity of the information on such a financial chat room is high.

Creative ways of enticing contribution, particularly where contributions cannot be demanded, are more and more necessary. It is likely that games, free services and other fun activities are going to be needed in order to encourage users to help build their own communities.

Consensus

While boring to outsiders, in many financial people's view "price discovery is the best fun in the game". Everyone knows the thrill of an auction. Financial markets provide many variations on this thrill. Certainly much of the .dotcom hype centred on efficient market processes, e-trading pits and suchlike. While it is easy to mock the failures, certain markets, such as those for credit derivatives, have been built in recent years on online community systems. The key difficulty with online markets has been achieving liquidity, i.e. a critical mass of buyers and sellers. Liquidity is closely aligned with problems of building "community".

To date, new market initiatives have been a bit "hit or miss". Sometimes a critical mass develops. Sometimes not. In some cases, for instance Catex, a not-quite-realised exchange of insurance catastrophe risk is nevertheless a successful bulletin board where business is initiated. Liquidity tends to have an inverse relationship with transparency. When information is forced to be disclosed (full transparency) then liquidity is often driven away (large, important trades occur elsewhere). What is clear, is that online financial communities aspire to being loci for price discovery, yet have to build critical mass to be both liquid and transparent.

Collaboration

Straight through processing (STP) initiatives abound, Omgeo, GSTPA (now defunct), Londex (now defunct) or SwapsWire, to name but a few. Wholesale finance needs to increase efficiencies. Variances in cost processing are high. Mis-keyed trades and fails are far too common. Operations efficiencies are low compared with rigorous quality industries, lower if the comparison takes account of the almost wholly-digital nature of finance as contrasted with, say, the operational difficulty of constructing a mobile phone sourced globally from components involving displays, millions of transistors and hazardous chemicals all linked through a dynamic radio network. A number of initiatives are underway, many revolving around XML, e.g. Bolero.net for the shipping and insurance markets, FpML.org for financial standards or FXML for currency exchange. Most of the initiatives focus on standardizing information exchange. Future initiatives are likely to focus on standard procedures and workflow.

Commitment

Commitment to a community by people means that they "trust" the community. Trust is an elusive and elastic concept - trusting information you are given, trusting others that they understand information you have given, trusting individuals to act as you expect them to, trusting others to make decisions on your behalf, entrusting others with your assets. In financial markets, the ultimate element of trust is marrying "dictum meum pactum" (my word is my bond) with "putting your money where your mouth is". When transactions occur, transactions of information up to financial transactions, the counterparties would like to know that everyone in the chain of events who gets a reward bears some risk. For example, the provider of today's market price should be paid, but provide recourse if they have provided inaccurate prices. The person who settles the transaction should be paid for their work, but be penalized if they make mistakes.

On the other hand, many organizations in the chain of events try to disclaim responsibility, e.g. for the accuracy of information. Lack of trust in these chains has been at the root of big failures, e.g. the closure of GSTPA. Successfully building high levels of trust leads to success, for example, the recent opening of CLS Bank. CLS performs continuous linked settlement for foreign exchange. It succeeds because CLS takes responsibility for settlement (trust) while, through its continuous nature, it innovatively removes risk. On the other hand, many technology companies provide adequate technical solutions to financial transaction problems (e.g. accurate, real-time trades) but fail to back the solution with indemnities if they fail, often because their balance sheets cannot sustain a reasonable case cumulative failure.

It is likely that commitment will take the form of more third-party guarantees. These guarantees will range from simple kitemarks (so-and-so adheres to XYZ standard and has been audited accordingly) to kitemarks backed up by industry guarantees to full-blown insurance behind transactions. Tradeable guarantees are but a step away, permitting the original cojoined risks of transaction and guarantee to be split and placed with people who desire each separate risk.

Conclusion

Virtual financial communities are real, significant and growing. Firms have only started to scratch the surface of how technology can help to build these communities. It is not the technological capability that is important; it is the ability of new technology ideas to capture communities' trust, i.e. managing risk and reward.

The technology is here. What is needed are novel ideas for using technology. Ideas for building virtual financial communities will succeed if they attract people, engage people, retain people, build trust and spread to new people. Some ideas already have.

Michael Mainelli originally did aerospace and computing research, before stooping to finance. Michael was a partner in a large international accountancy practice for seven years before a spell as Corporate Development Director of Europe's largest R&D organisation, the UK's Defence Evaluation and Research Agency, and becoming a director of Z/Yen (Michael_Mainelli@zyen.com). Michael has advised banks and insurers globally on strategy, systems, operational risk, outsourcing, activity-based costing and computerisation. Michael's humorous risk/reward management novel, "Clean Business Cuisine", co-authored with Ian Harris, was published in 2000. Banking Technology said it gives "a big picture grip on the details".

Z/Yen Limited is a risk/reward management firm helping to improve organisations through better choices. Z/Yen undertakes strategy, finance, systems, marketing and intelligence projects in a wide variety of fields (www.zyen.com), such as developing a stochastic prediction engine or benchmarking transaction costs across 25 global investment banks or advising on wholesale financial services marketing.

[A version of this article originally appeared as "Risk/Reward in Virtual Financial Communities", Information Services & Use, Volume 23, Number 1, IOS Press (2003) pages 9-17. A similar paper was presented at the EUSIDIC Conference in Lisbon, Portugal (September 2002).]